jefferson parish property tax search

Homestead Exemption Deduction if applicable-7500. Please call the office at 504 363-5710 between 800AM and 430PM Monday.

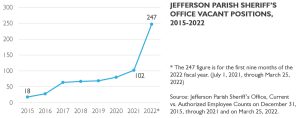

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

The site is down for maintenance while the new tax roll is being updated.

. Utilize our e-services to. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street.

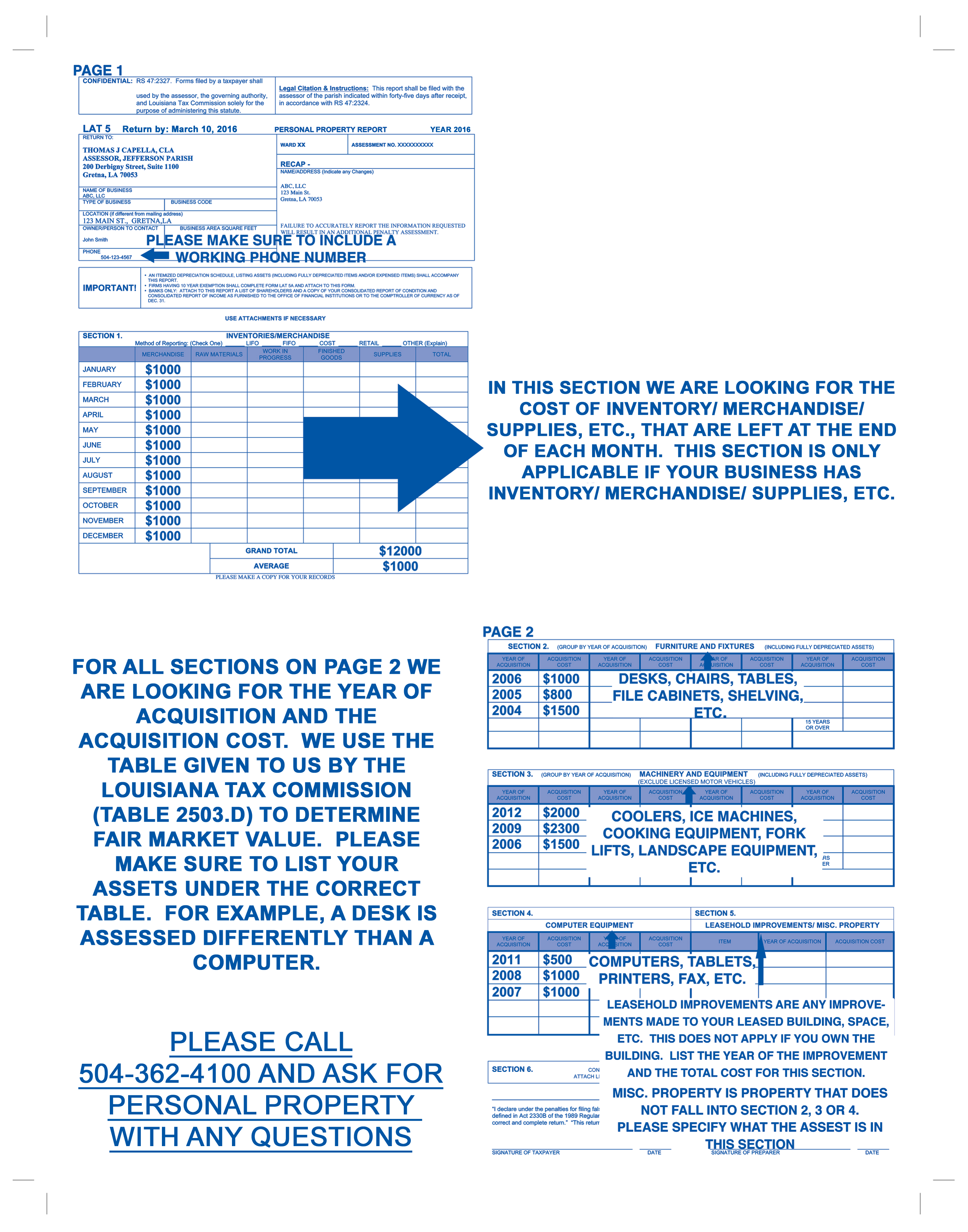

Parish Attorneys Office Code Collections 1221 Elmwood Park Blvd Suite 701 Jefferson LA 70123 Fax. Please call 504-362-4100 and ask for the personal property. Property Tax Calculation Sample.

Jefferson Parish Property Tax is due on November 30th of each year. Jefferson Davis Parish Assessor Information and Property Search. Taxed Value 12500.

Jefferson Parish in conjunction with Lone Star Auctioneering Company will be hosting a Jefferson Parish online surplus property auction from Wednesday October 26 Wednesday. Market Value 200000. The Parish Assessors Office mails out the tax bills in October.

Welcome to the Jefferson Parish Assessors office. Only open from December 1 2021 - January 31 2022. Search Jefferson Parish residential property records for free including maps owner and structure details mortgages deeds loans sales records tax history assessments and.

2021 Plantation Estates Fee 50000. Jefferson Parish Wards. When you click on the Jefferson Parish.

Online Property Tax System. Property Taxes Mortgage 80003600. Parcel Owner Location Assessment.

Perform a free Jefferson Parish LA public tax records search including assessor treasurer tax office and collector records tax lookups tax departments property and real estate taxes. Assessed Value 20000. Welcome to the Jefferson Parish Assessors office.

Jefferson Parish Property Tax Collections Total Jefferson Parish Louisiana. 200 Derbigny St Suite 1100. Jefferson Parish Sheriffs Office.

Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. These taxes may be remitted via mail hand-delivery or filed and paid online via our website. Welcome to the Jefferson Davis Parish Assessor Web Site The Jefferson Davis Parish Assessor is responsible for discovery listing and valuing all property in the Parish for ad valorem tax.

Government Building 200 Derbigny 4th Floor Suite 4200 Gretna LA 70053 Phone. For Properties Located on the.

Jefferson Parish Assessor S Office Resources

Jefferson Parish Louisiana Genealogy Familysearch

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Jefferson County Tax Assessor Bessemer Division

Property Assessment Faq St Tammany Parish Assessor S Office

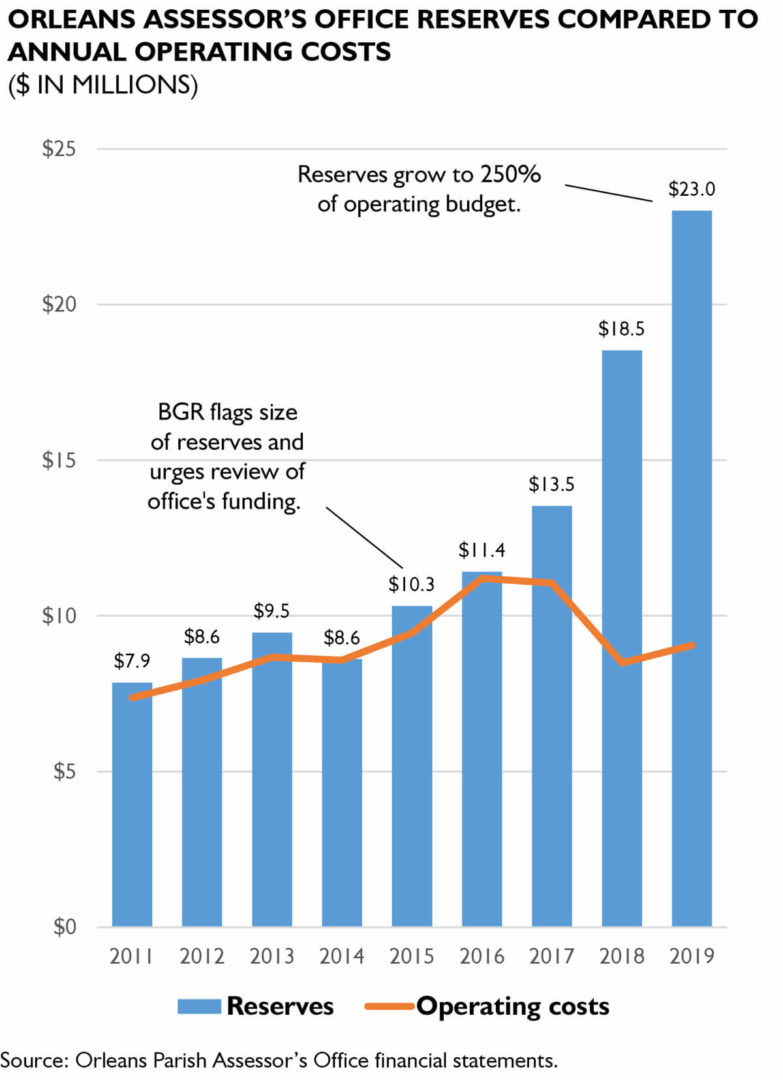

Policywatch Revisiting Assessment Issues In New Orleans

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Jefferson Parish Gift Deed Form Louisiana Deeds Com

Civic Associations Jefferson Parish Sheriff La Official Website

Jefferson Parish Voters Approve Water Sewer Taxes Westwego Picks New Mayor

2022 Best Places To Buy A House In Jefferson Parish La Niche

Jefferson Parish Proposed New Property Tax To Pay For Teacher Pay Raises

Jefferson Parish Assessor S Office Property Search

Jefferson Central Appraisal District

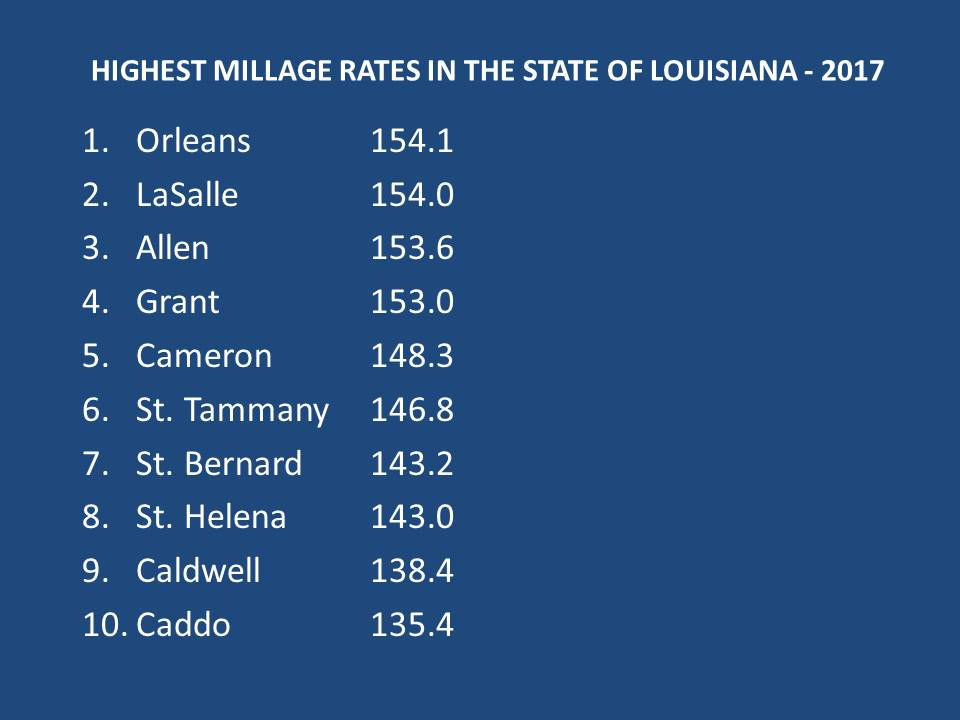

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

Following Scrutiny Of Invalid Tax Exemptions For Two Folgers Properties Worth 40m Orleans Property Assessor Promises Comprehensive Review Of Property Tax Breaks The Lens